READ MORE: 5 Conversational AI Use Cases for Insurance

Insurance Chatbots:

Transforming Your Customer's

Journey with Chatbots

Insurance is a serious and complex subject. It is a product that requires a significant investment on the part of the customer, not just financially, but also in terms of time and attention. When it comes to securing the life, health, and finances of themselves and their loved ones, insurance customers would not want to leave anything to chance. They demand access to detailed information and expert guidance while evaluating plans and policies, in order to make an informed decision. And they also need constant post-purchase support when it comes to making inquiries about their policies or filing insurance claims. This is where an insurance chatbot can help.

It is against this backdrop that Conversational AI has emerged as a powerful tool for enterprises to engage and serve their customers.

What is an Insurance Chatbot?

According to Genpact, 87% of insurance brands invested over $5 million in AI-related technologies each year. Long gone are the days when artificial intelligence was a buzzword, or even just something that was ‘good-to-have’ – it is now very much a ‘must-have’. A key strategic area on which insurers have placed a strong bet is enhancing customer experience, and the AI technology that is best suited to realizing that objective is Conversational AI – in the form of a chatbot or Intelligent Virtual Assistant.

An insurance chatbot is an AI-powered virtual assistant solution designed to cater to the needs of insurance customers at every stage of their journey. Insurance chatbots are revolutionizing the way insurance brands acquire, engage, and serve their customers. The confidence in Conversational AI within the insurance sector is certainly high, with 71% of insurance executives believing strongly that customers will prefer interacting with an insurance chatbot over a human agent by 2021.

How Insurance Chatbots Help Customers

Demystifying Insurance

Insurance is often perceived as a complex maze of quotes, policy options, terms and conditions, and claims processes. Many prospective customers dread finding ‘hidden clauses’ in the fine print of insurance policies. There is a sense of complexity and opacity around insurance, which makes many customers hesitant to invest in it, as they are unsure of what they’re buying and its specific benefits.

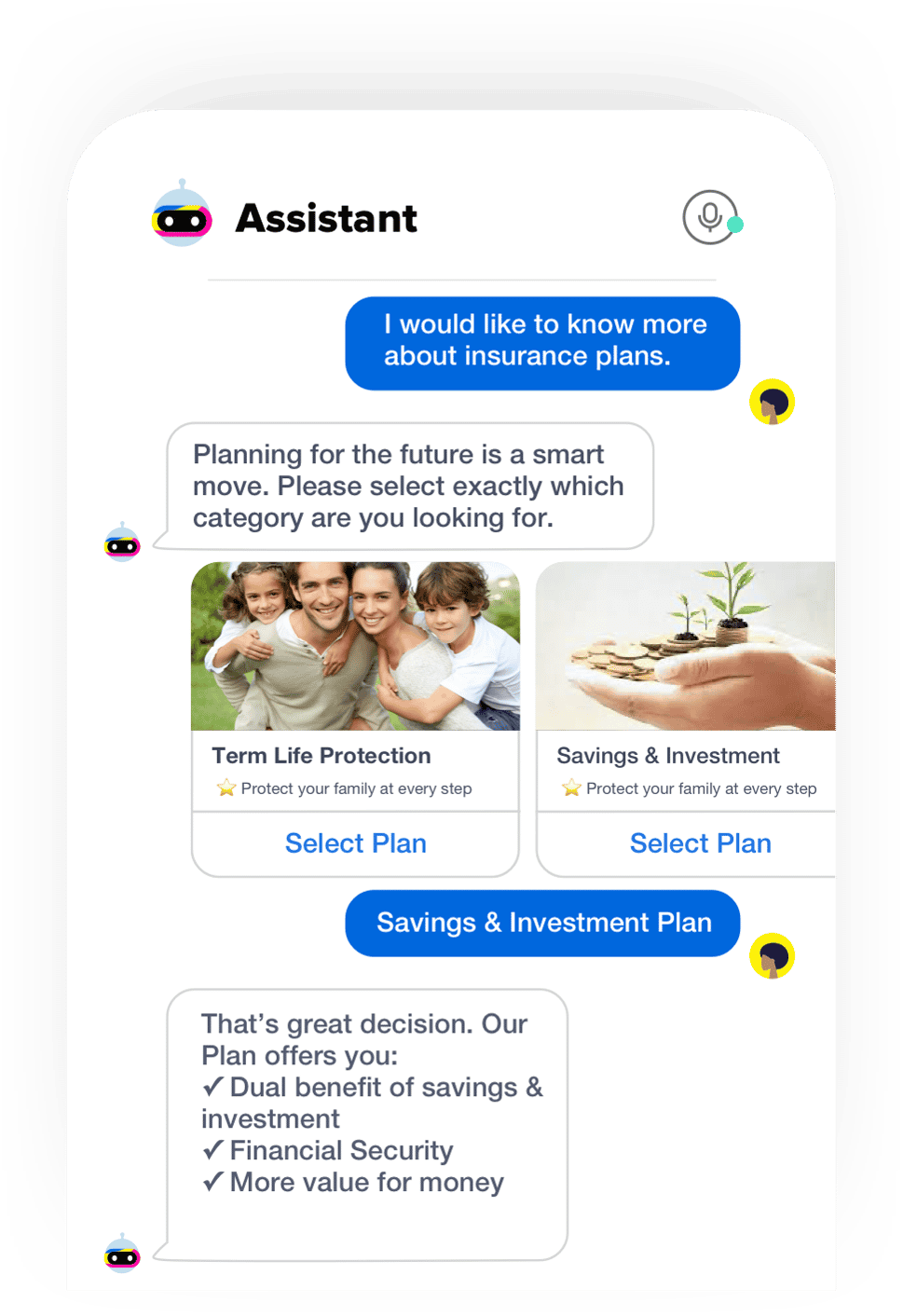

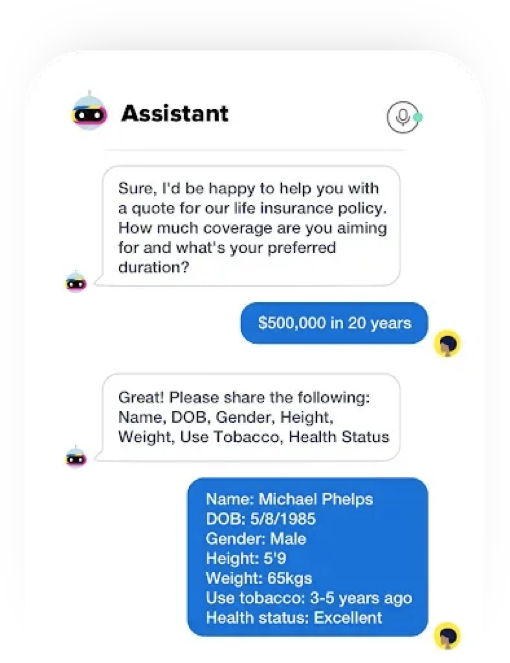

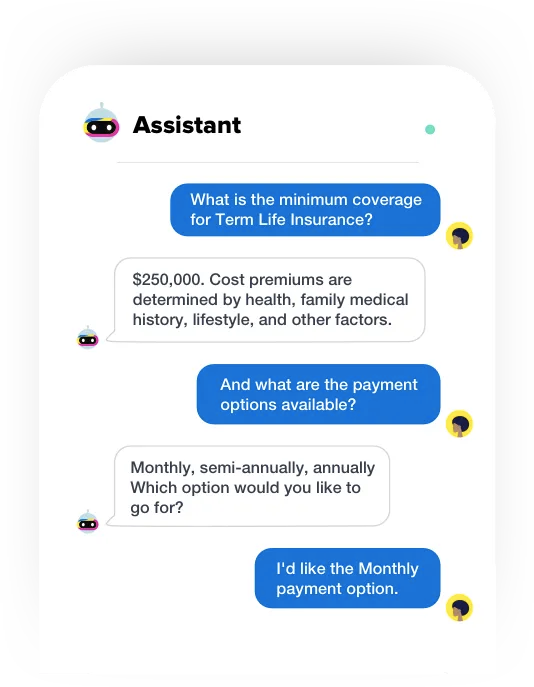

An insurance chatbot is available 24/7 to handhold insurance customers every step of the way. Much like a human insurance agent, the chatbot asks customers questions about their requirements, along with other details. It can then offer them personalized policy recommendations, help them compare two or more plans, and help them get a clearer understanding of policy options by answering any follow-up questions.

READ MORE: How Conversational AI Enhances the Insurance Customer’s Journey

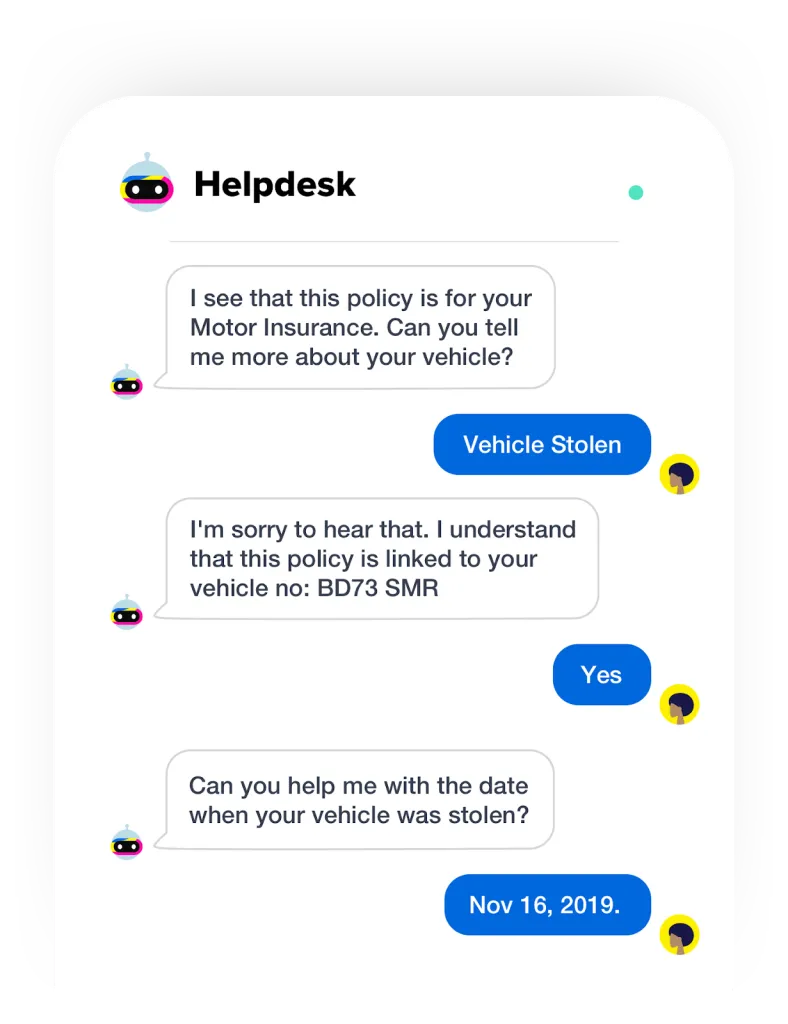

Insurance chatbots offer a swifter and more efficient customer care experience, particularly when it comes to filing a claim. Instead of having to constantly follow-up on the claim with a customer care representative, the customer can instead simply tell the chatbot the nature of the claim. The chatbot can simply pull up the customer’s policy from the insurer’s database or CRM system, ask the customer to provide any additional details, and then immediately initiate the claims filing process. All this, in a matter of minutes!

READ MORE: Why Should Insurance Companies Consider Implementing Insurance Claims Chatbots?

How Insurance Chatbots Help Brands

Reducing Costs

80% or more of inbound queries received by insurance chatbots are routine queries or FAQs. An insurance chatbot can seamlessly resolve these queries end-to-end, while redirecting the remaining 20% of complex queries to human agents. This human + AI approach to customer care is highly beneficial to insurance brands in a number of ways.

READ MORE: Why Conversational AI is the Best Partner Insurance Agents Can Have

Using an insurance chatbot significantly reduces an insurer’s customer support costs, since a single chatbot can handle the volume of queries that would otherwise require a large customer care staff. It is also swifter, easier and more cost-effective for an insurance brand to scale up their customer support capacity using an insurance chatbot, rather than hiring, training and retaining greater numbers of human agents.

Helping Insurance Agents

While a popular belief about chatbots is that they will make human agents completely redundant, that is not entirely true. Chatbots can actually work for insurance agents, complementing their efforts and helping them carry out their jobs more effectively. With the chatbot automating routine, mechanical tasks, insurance agents can focus their attention on solving more complex customer issues, and having more meaningful interactions with current or prospective customers. Insurance chatbots also help enrich agent interactions with customers by gathering data about the customer’s intent, requirements, risk profile etc. providing the agent with more context about what the customer wants.

Lead Generation

Insurance chatbots are a great tool for lead generation. They acquire visitors on the insurer’s website and other digital touchpoints with intelligent prompts, keep the visitor engaged by answering their queries and offering relevant information, ask them questions about their insurance requirements and collect their details over the course of the conversation. The engaging interactive lead form on a chatbot leads to more conversions as compared to traditional long and static lead forms.

Moreover, when equipped with an AI-powered recommendation engine, the insurance chatbot can offer personalized policy recommendations to a prospect. By offering them not just general information, but also concrete recommendations, the insurance chatbot increases the likelihood of the prospect exploring the purchase further.

READ MORE: Why Conversational AI is the Perfect Lead Generation Tool for Insurance Brands

Insurance Chatbot Use Cases

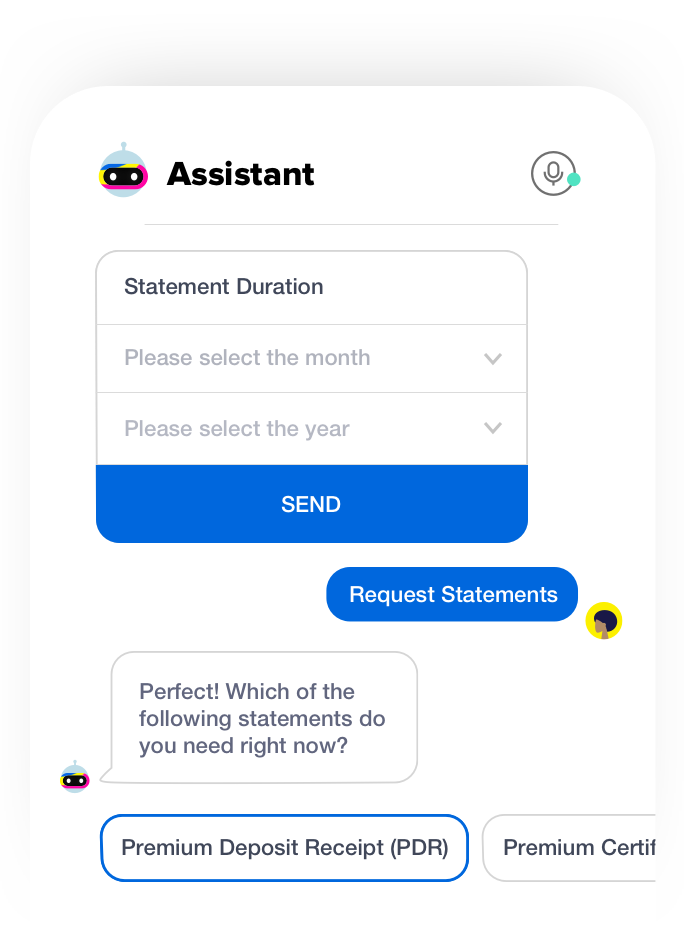

Insurance chatbots can tackle a wide range of use cases across two key business functions – Customer Care and Commerce.

Customer Care

- Claim submission

- FAQs

- Policy status

- Schedule payment

- Claim submission

- Policy enrolment

- Update policy

- Change beneficiary

- Edit details

- Premium certificate

Commerce

- Benefits and coverage

- Compare plans

- Insurance advisor

- Insurance calculator

- Upsell policy/products

- Policy add ons

- Flexible payment plans

- Add members

- Group plans

- Recommended care practitioner

A Globally Recognized Insurance Chatbot Platform

Haptik has been recognized by Gartner as sample providers of insurance chatbot and virtual assistant solutions in their report, Emerging Technologies and Trends Impact Radar: Artificial Intelligence in Insurance – a testament to our commitment to driving digital transformation for insurance brands.

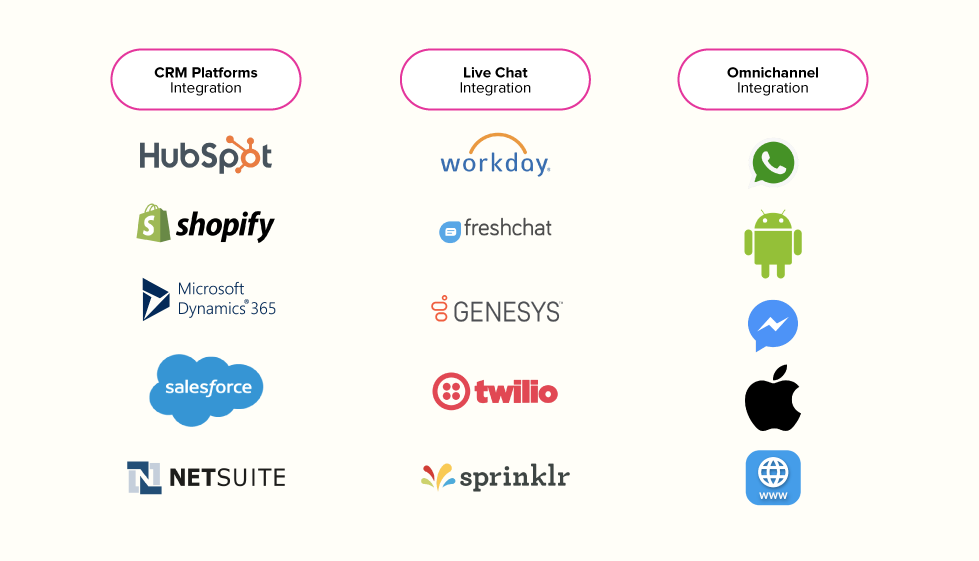

Enable Customer Engagement through Seamless Integrations

Large enterprises rely on an ecosystem of vendors, products and solutions for different business requirements and across touchpoints. Insurance brands are no exception to this.

Recognizing this need, Haptik has built insurance chatbot solutions with out-of-the-box integrations. This enables insurers to swiftly integrate API’s, integrate the chatbot with the CRM or Live Chat systems of their choice, and enable omnichannel integration with a wide range of digital platforms or channels.

Insurance Chatbot Case Studies

As a global leader in Conversational AI, Haptik has implemented insurance chatbot solutions for a number of leading insurance brands. Here are some of our success stories in the sector:

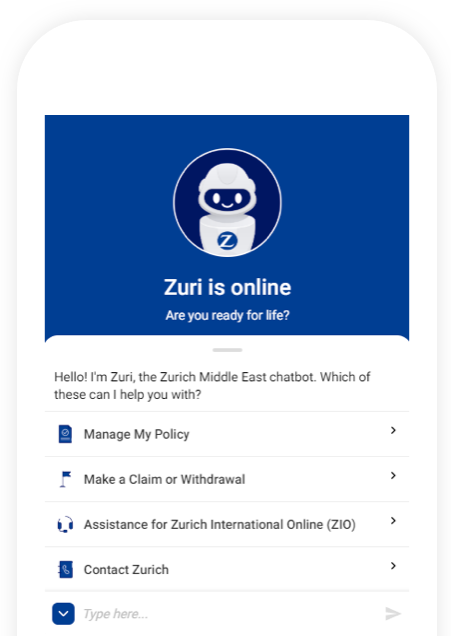

Zurich Insurance

Zurich, one of the world’s largest and most experienced insurers’, needed a solution to transform their customer care experience and make it as frictionless and easy-to-access as possible. Learn how Haptik’s insurance chatbot seamlessly resolved 70% of Zurich’s inbound customer queries end-to-end.

READ MORE: Zurich Insurance Case Study

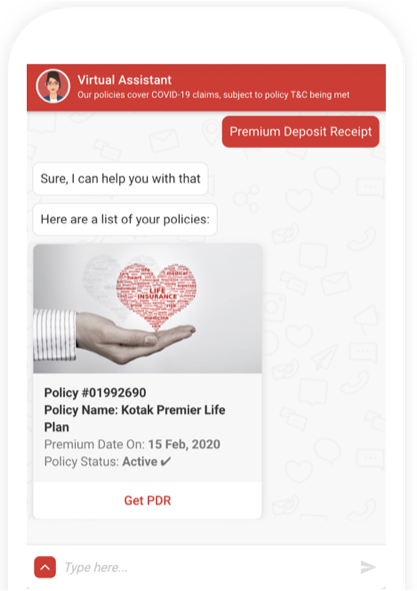

Kotak Life Insurance (KLI)

KLI, a leading insurance provider, wanted to make customer care more self-serve and asynchronous, improve customer engagement, and give a boost to their lead generation efforts. Learn how Haptik’s insurance chatbot helped enhance KLI’s customer engagement by 500%.

READ MORE: Kotak Life Insurance Case Study

Looking Ahead

As Conversational AI, and other AI technologies, continue to evolve, the capabilities of insurance chatbots will continue to expand. From accessing insurance voice assistants through smart speakers, to instantly getting insurance on-demand while on the move, insurance is going to become even more accessible, and the customer experience even smoother, in the years to come. But in the here and now, insurance chatbots already have the ability to revolutionize the sector and make life easier for customers and insurers alike.

READ MORE: Conversational AI in Insurance: A Glimpse of the Future