The tremendous benefits of Conversational AI implementation in the insurance sector are already becoming evident. Using AI-powered Intelligent Virtual Assistants (IVA), leading insurance brands have been able to overhaul their customer care by automating the end-to-end resolution of over 80% of inbound queries, while significantly cutting down on operational costs in the process. AI Assistants also help insurers drive sales, by engaging prospective customers across digital touchpoints.

Undoubtedly, Conversational AI has a significant positive impact on an insurance brand’s bottom line. And ultimately, this comes down to two words: Customer experience.

An insurer can only reap the benefits of an AI Assistant solution if it makes things simpler, faster, and more engaging for the customer, leading to a good experience during the interaction, and an overall positive perception of the brand.

Let’s explore how Conversational AI enhances the insurance customer’s journey.

Making Insurance More Accessible to Customers

Insurance is something that everyone needs, but not everyone can always understand. Many customers perceive insurance to be a complex maze of policy options, quotes, terms, and conditions claims processes, and perhaps most dreaded of all… ‘hidden clauses' in the fine print! This complexity and perceived opacity leave many potential customers hesitant to buy insurance, as they’re worried that they don’t know exactly what they’re buying and its specific benefits.

Conversational AI goes a long way towards bridging these knowledge gaps and creating an environment of clarity and transparency around insurance. An AI Assistant can provide instant responses to all of a customer’s queries around plans and policies, benefits and coverage, pricing, payment plans, and more.

Beyond providing information and resolving any doubts, an insurance chatbot can also serve as a virtual insurance advisor to customers. Much like a human insurance agent would, it asks the customer questions about their requirements and offers personalized policy recommendations based on their responses. It also allows the customer to easily compare two or more plans, and provide a clearer understanding of the benefits of a policy through features like interest calculators.

Another way AI Assistants help make insurance more accessible to customers is by being more accessible themselves! An omnichannel virtual assistant can engage prospective insurance customers on their preferred channels, be it messaging platforms like Facebook Messenger, Slack Telegram, or WhatsApp; a website or an Android or iOS app. The availability of the AI Assistant across digital platforms particularly appeals to Millennial customers, who have been found to buy insurance less often than previous generations. Conversational AI thus helps insurers better engage with a demographic that is poised to be a key audience for them for the foreseeable future.

Read Success Story: Zuri - Chatbot of Zurich Insurance, World’s Leading Insurance Company.

Keeping it Simple

The processes involved in buying, renewing, or claiming insurance further add to its complexity. By automating these processes, Conversational AI makes the purchase and post-purchase experience as simple and frictionless as possible.

Typically, the purchase journey for an insurance customer would involve going through pages and pages of text filled with technical terms and industry jargon, in order to evaluate policy options. This would no doubt be followed by in-person meetings or phone calls with insurance agents. All of this requires the prospective customer to invest a considerable amount of time, and they may still not have complete clarity about the relative benefits of one policy compared to another at the end of this process.

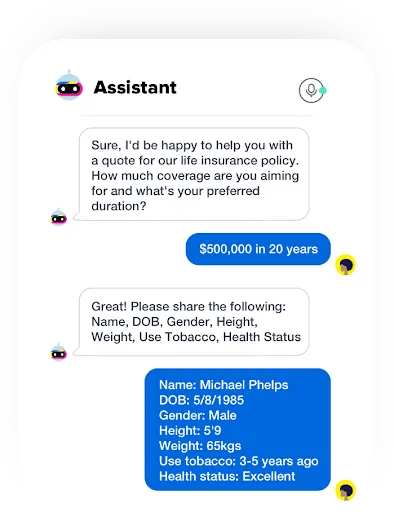

An AI Assistant makes this a lot simpler. All the customer would need to do is tell the assistant the kind of insurance they’re looking for, answer questions about relevant personal details (for e.g. age, height, weight, tobacco use in the case of health insurance or life insurance), and provide other specifications (for e.g. how much premium they would be willing to pay). Based on these answers, the assistant would provide a list of suitable policy options, and answer further questions regarding each policy.

The process of evaluating insurance options thus becomes a lot simpler and faster over a conversational interface. And once the customer has made a selection, the AI Assistant can also guide them towards the next steps required to take the purchase forward.

Filing a claim is another area where AI Assistants come to the rescue of customers in a big way! The customer needs to simply inform the assistant of the nature of the claim. The assistant can pull up the details of the customer’s policy from the insurer’s database or CRM system, ask the customer for any additional details required, and then initiate the claims process.

This saves the customer the trouble of having to constantly follow up on the claim with a customer care representative over phone and e-mail, a process that can be time-consuming and even a little frustrating given the long wait times involved. With an AI Assistant to help, the customer can rest assured that there will be no delays in their claim coming through!

Read More: Why Should Insurance Companies Consider Implementing Insurance Claims Chatbots?

Looking Ahead

As Conversational AI becomes even more ubiquitous in insurance, customers can look forward to an even more seamless experience when it comes to buying insurance or making a claim. For instance, voice assistants would enable customers to engage with their insurance companies through their smartphones or smart speakers with even greater ease. Sensors in ‘smart devices, appliances or vehicles could assess the extent of any damage, ‘talk’ to insurers to determine the cost of repairs and the size of the claim – with the customer being informed of this by the AI Assistant.

But even at present, AI Assistants are already well-equipped to make things considerably easier for insurance customers at every stage of their journey. This means a better customer experience, which ultimately translates to more business for the insurer. A win-win for all stakeholders!

Read More: The State of Insurance Chatbots in 2022: Use cases, Reports, case studies, and more.

.png?quality=low&width=352&name=Linkedin+%20Twitter%20(2).png)