How Tata Mutual Fund Achieved 58% Growth in Engagement

Overview

Part of the Tata group, Tata Mutual Fund is the most trusted fund house in India offering a range of investment solutions for financial planning and wealth creation. Tata Mutual Fund wanted a solution that would help them better serve digital-first millennials who demand support on-the-go. Tata Mutual Fund partnered with Haptik to offer a platform which was easy to use and implement. The resulting solution was an AI powered chatbot which resulted in a near perfect query resolution.

Haptik is a fantastically committed team. They truly understand their business and they go really deep to understand their customer's issues.

Haptik is a fantastically committed team. They truly understand their business and they go really deep to understand their customer's issues.

Head – Marketing & Digital

Challenge at Hand

The objective was to improve customer experience by providing faster query resolution and minimizing human intervention.

-

Tata Mutual Fund wanted a 70% reduction in monthly customer calls.

-

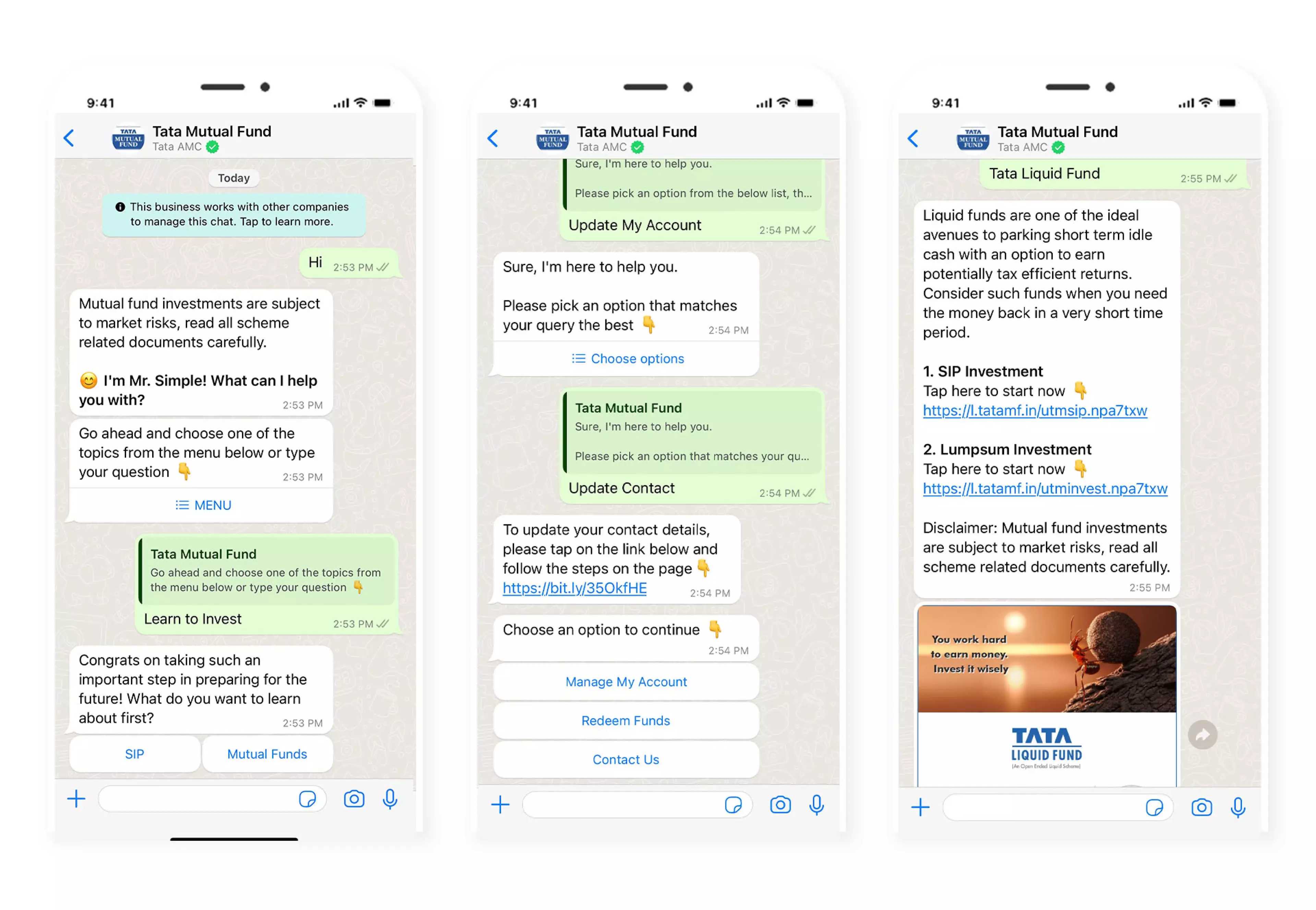

They wanted to engage customers on their preferred channels, such as Messaging & WhatsApp, and needed an AI-driven solution that could be integrated with the existing customer support infrastructure.

-

The solution was to be focused on offering an easy way to get customer queries resolved. The platform was expected to be integrated into existing customer service channels.

How Haptik Offered a Solution

Haptik brought a digital-first approach to Tata Mutual Fund’s customer support, implementing a virtual assistant that helped them resolve routine queries end-to-end, freeing agents to focus on high-value issues.

-

The chatbot would integrate with backend systems to ensure effective information dissemination for immediate follow-up and closure.

-

An improvement in user engagement was observed by using intelligent prompts and content flows.

-

The chatbot was designed to provide customers with automated answers to simple queries, while still allowing agents to intervene when needed.

As we add new customers every day, the IVA seamlessly handles 70% of query flow, helping us achieve incredible customer satisfaction rates, exceeding anything ever seen before.

As we add new customers every day, the IVA seamlessly handles 70% of query flow, helping us achieve incredible customer satisfaction rates, exceeding anything ever seen before.

Head – Marketing & Digital

Results

With the vision of creating the most compelling conversational commerce platform of the 21st century, Haptik’s Conversational Commerce platform enables brands to design delightful experiences that improve conversion rates across every stage of their customer’s journey. By utilizing AI-enabled automation and deep customer insights, Haptik’s platform offers a more efficient and cost-effective way to engage customers in meaningful conversations. The results were near perfect. Tata Mutual Fund observed a 90% end-to-end query resolution and an immense reduction of 67% in call center queries.

Other Customer Stories

Learn more about the results achieved by Haptik's clients