Why Conversational AI is the best partner for Insurance Agents

AI-driven automation has been a consistent goal for enterprises across verticals over the past several years; and recent events, particularly the COVID-19 pandemic, are only likely to make it a higher priority. The insurance sector is no exception to this trend. A 2017 study by McKinsey suggests that AI automation could reduce the cost of a claims journey by as much as 30%!

Cost savings is always a major theme when it comes to discussions around AI automation, and rightly so. This understandably generates a lot of apprehension about the future role of human agents. For instance, the increasing adoption of Conversational AI solutions by insurance brands to drive sales and handle customer care does raise questions about whether insurance agents need to start fearing for their jobs.

Or does it?

The truth is that in this ongoing journey of digital transformation, insurance agents and AI Assistants need not be at odds. While AI Assistants can and will take over some of the functions traditionally performed by agents, in the long run, they can play complementary roles.

Let us explore some of the key reasons why Conversational AI will help insurance agents do their jobs a lot better.

Freeing Insurance Agents from Routine Tasks

As we discussed at the start, one of the key incentives for insurance brands to implement Conversational AI solutions is saving costs. An AI Assistant can help insurers slash their customer care costs by as much as 90% – by automating the response to the large volumes of routine queries and FAQs that they receive on a daily basis.

Typically, insurance agents would need to invest a lot of time and effort in answering these routine queries. With a chatbot for insurance agents taking this task off their plate, the agent can invest their time and effort entirely on more crucial and high-value work, such as handling more complex customer queries from prospects, and working on retaining clients.

Being freed from mundane, repetitive tasks can serve as a motivating factor for insurance agents, and significantly boost their overall productivity.

Read the Success Story: Zuri - Chatbot of Zurich Insurance, the World’s Leading Insurance Company.

Enriching Agent Interactions with Customers

With Chatbot for agents handling routine tasks, insurance agents can now focus their attention on having more meaningful interactions with customers, offering a better customer experience and increasing the likelihood of a successful conversion.

Conversational AI serves as a great source of data for insurance agents. While interacting with prospective customers, the AI Assistant gathers data about the customer’s intent, requirements, risk profile etc. This data provides the agent with better context on precisely what the customer is looking for, which serves as a helpful guide during their own conversations with the prospect.

Learn More: Why Conversational AI is the Perfect Lead Generation Tool for Insurance Brands

The conversational data gathered through customer interactions with the AI can also provide insurance agents with rich insights on consumer behavior, including meaningful patterns and correlations, which will aid them in evolving better decision-making processes.

E-BOOK: Implementing Conversational AI – What Insurance Brands Should Keep in Mind

The Need for Human-Agent Escalation

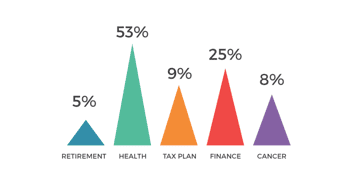

Human agents are a vital part of ‘the machine’, as it were when it comes to implementing Conversational AI solutions. While customers have become comfortable with the idea of engaging with businesses through chatbots or virtual assistants, this comfort level is to a large extent down to the ‘assurance’ that human intervention is possible. According to a study by PointSource, 49% of consumers would feel better about interacting with an AI Assistant if they had a clear option to escalate to a human agent.

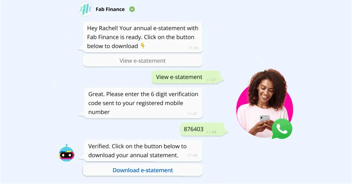

This is particularly crucial in the insurance sector. Conversational AI has come a long way in recent years, but it’s relatively early days for the technology. As we’ve discussed, AI Assistants are most effective when it comes to automating routine and repetitive tasks. At some point in the insurance purchase process, the experience and expertise of a human insurance agent will be needed to handle more complex queries and issues and to simply provide that much-needed ‘human touch’.

Learn More: Live Chat Agent – Bringing a Human Touch to Conversational AI

Insurance is a purchase that buyers are heavily invested in, not just financially but emotionally as well. It also involves sharing sensitive personal and financial information. The reassuring presence of a knowledgeable, trustworthy, professional insurance agent will go far in alleviating any concerns they might have about the process. That’s the way it’s always been, and the existence of Conversational AI does nothing to change that!

The Way Forward

AI automation will significantly transform the insurance sector in the years to come. And this disruption will impact human insurance agents. However, the way forward is not an ‘AI vs. humans’ paradigm, but rather finding ways to ensure that Conversational AI and insurance agents play a complement each other’s capabilities.

Chatbot for insurance agents brings much-needed swiftness, precision, and efficiency to the process of selling insurance, but insurance agents bring the indispensable personal connection that is vital to the ultimate success of the insurer.

Use cases, Reports and Case Studies: The State of Insurance Chatbots in 2022

Want a Conversational AI solution for your brand?